Coates Finance » Equipment Finance » Manufacturing Equipment Finance

Finance and Lease Manufacturing Equipment and Machinery

Manufacturing Equipment Finance

Advance your Business

Manufacturing Finance Assembled to Grow your Operation

UK manufacturing has an important role to play in business, not just in this country, but globally. 44% of total UK exports are from the manufacturing industry and include all manner of machinery, from knitting machines to nuclear reactors.

The technological advancements in the last few decades have meant that manufacturing is becoming more efficient, cheaper and capable of fulfilling large orders in timescales previously unheard of. There are over 2.5 million people employed in the manufacturing industry, making it a major player in the global economy.

Lease and Finance your Manufacturing Equipment and Machinery with Coates

Coates Asset Finance can offer your business a range of finance agreements so you can buy the most up-to-date equipment to compete in a booming industry.

Loans

- Secured & Unsecured

- Simple process

- Full transparency

- Easy to manage repayments

Lease

- Fast decision

- Options to suit you

- Affordable deposits

- Low upfront costs

Refinance

- Customised plans

- Free up cashflow

- Competitive rates

- Fair Valuations

Call Us Today for a FREE No Obligation Quote: 01904 948008

Creating a Productive Business and Managing Your Growth

Finance for the Manufacturing Industry

Innovation and Advancement

PwC’s Annual Manufacturing Report has found that “94% of manufacturers are adjusting their business in new ways to achieve growth” and “78% are developing (or have developed) a servitude business model that adds value to customer relationships”.

Far from hiding from change, the manufacturing industry has the confidence to innovate and adjust to many factors affecting their businesses, including climate change and global competition.

Brexit has had a vast impact on the sector, with the uncertainties of exporting from a new, independent UK to countries in the EU and beyond.

How Innovation and Advancement will Benefit your Manufacturing Business

Being abreast of manufacturing advances can transform your business by employing new talent, adopting the latest technologies to enhance your processes and systems and embracing digital opportunities.

Keeping up with demand, from customers as well as the ever-changing economy, means that the industry will need to continue to deliver products and services by transforming their business with new equipment, machinery and technology.

Flexible and Cost-effective Solutions

The potential high cost of financing your startup, or scaling your already established company doesn’t have to be prohibitive. Manufacturing finance is a simple process with easy to manage terms when you partner with Coates Finance.

Reap the Benefits of Asset Finance

Increase your Productivity

When it comes to investing in the manufacturing market, the whole world benefits.

In developing countries, mass-produced products make them affordable and accessible for everyone.

In more developed countries, every item imaginable comes from our manufacturing industry – from a packet of sweets to a combine harvester.

Manufacturing machinery and equipment finance gives you the best chance of growing your business without stripping you of all your cash.

With over 20 years’ experience, Coates have arranged many solutions to manufacturing businesses across the UK, so that they can continue to produce while scaling their company.

Purchase your equipment with Coates

You can use one of the following solutions we arrange for manufacturing businesses.

- Hire Purchase

- Finance Leasing

- Operating Lease

- Asset Refinance

- Commercial Business Loans

- Secured Business Finance

- Unsecured Business Loans

- Working Capital Loans

Our asset finance experts help your company stay viable while getting ahead so you can continue to diversify and grow your manufacturing business.

If you’re looking to fund any manufacturing equipment, complete the form below to request a call back or call us today for a complete solution.

List of Manufacturing Equipment and Machinery

Here’s a list of the most common appliances you can buy with your manufacturing equipment finance and lease solution:

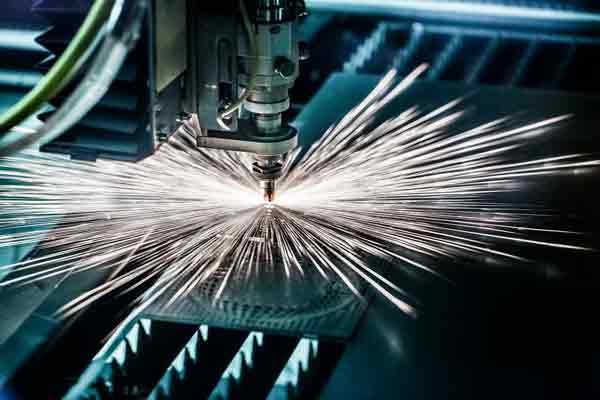

- Milling machinery

- Lathe

- Mig and Arc welders

- Packaging systems and machines

- Loading machinery

- Production robots

- Grinding and finishing machinery

- Vacuums, dust collectors and oxidisers

- Coating equipment

- Filtration and separation products

- Gas handling equipment

- Heating and cooling equipment

- Cleaning and surface preparation equipment

- Inspection tools and instruments

- Safety sensors

- Stamping and pressing equipment

- Extrusion plant

- Pilot plants

- Conveyor and elevator systems

- Wrapping machines

- Inspection and testing systems

- Inventory storage systems and racking

- Fork lift trucks

- Refrigeration plant

Call Us Today for a FREE No Obligation Quote: 01904 948008

We offer personalised funding Solutions

Manufacturing Equipment Financing and Leasing Solutions

Hire purchase allows you to obtain the Manufacturing equipment your business needs and pay for it in increments over a negotiated period.

At the end of the agreed-upon time, you will be offered the option to purchase the asset.

A finance lease works like a loan agreement that allows you to acquire the Manufacturing equipment and machinery your business needs without having to buy them outright.

Coates arranges for a funder to purchase the assets your business needs for you and lease them back to you over a negotiated time period.

An operating lease is an agreement that allows your business to use and operate equipment and machinery without committing to ownership.

The agreed-upon rental term of an operating lease is typically shorter than the life of the asset.

Asset Refinance is an ideal solution for your business if you also use heavy equipment, plant machinery or vehicles.

Also known as a sale and leaseback agreement, this finance solution allows your company to sell existing assets in return for working capital.

This enables you to still use your assets by leasing them back from us whilst freeing up cash for other purposes.

Secured commercial loan

A secured business or commercial loan is a loan secured against an asset of the borrower, giving them the working capital they need right away.

Unsecured Business Loan

An unsecured business loan allows businesses to obtain essential equipment without collateral.

Your Journey Begins Here

Partner with Coates Finance

Here is What You Need to Get Started

Fast Finance for Your Manufacturing Company in 3 Easy Steps

Partner with one of the UK’s leading asset finance providers.

Our friendly team of experts are waiting to assist you and your company.

We’ll help you find a solution that meets your needs, and take the hassle out of the decision-making process so you can spend more time on what matters to you most – growing your business.

We have streamlined the application process and made it super simple to apply for the funding you need.

Complete the short form below and let’s get started today.

Complete the form below and speak to one of our knowledgeable business finance professionals, who will answer your questions and guide you through every step to a solution that works for you.

You can also give us a call if you need immediate answers to your questions. Our friendly experts will happily answer any questions you may have before you begin your application.

Call us on 01904 948008

Lines are open

9:00am – 5:30pm Monday to Friday

(excluding UK bank holidays)

We'll Help you Every Step of the Way

Finance Your Manufacturing Business Today

Follow the simple 3 step process to finance your business today.

Once you have completed the first step, we will arrange a call to answer any more detailed questions you may have and move quickly through steps two and three to get your financial requirements successfully approved.

01

Complete the Form

Complete the simple form below and apply online for the amount you need to grow your business

02

Receive Fast Approval

We will process your application and aim to get you approved for your desired amount in 24 – 48 hours

03

Get Funded

Congratulations!

Now you’ve been approved, you can acquire the assets for you require to grow.

Call Us Today for a FREE No Obligation Quote: 01904 948008

Let's Get Started

All you need to do is complete the form and submit your inquiry to get your no obligation quote today

- Partner with one of the UK's leading asset finance providers

- Get sector specific solutions from the "smartest people in the finance industry"

- Apply in minutes and get a preliminary decision within the hour

- Access funds from £2000 - £500,000

- FREE tailored quotation with no obligation